Your Guide to COVID-19 Benefit Changes

As we all work to navigate the new normal that the global pandemic has brought about, there can be some confusion surrounding what this may mean–especially in the insurance world. With furloughs, temporary layoffs, and other changes to your workforce, how can you begin to navigate what this may mean for your organization and your employees?

Both the Department of Labor and the Department of Treasury has provided updates to both unemployment insurance and employer-provided insurance. Where can you find these updates? And how do you begin to navigate through them?

Below, are a few important benefit updates that will help give you safety in this uncertainty:

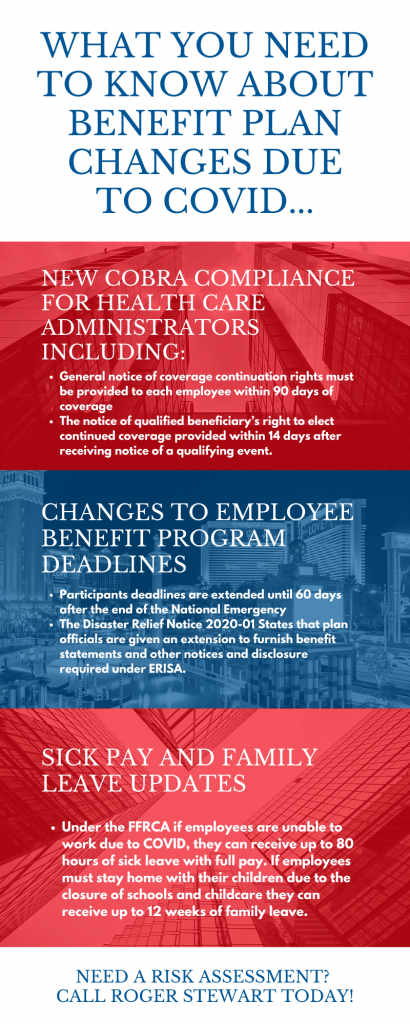

- The Department of Labor created a new model for COBRA compliance for health plan administrators, the compliance requirements include:

- Each employee much receive general notice of coverage continuation rights within 90 days of coverage.

- The qualified beneficiary must receive notice of their ability to elect continued coverage within 14 days of receiving notice of the qualifying event.

- Employee Benefit Deadlines: Relief ahead! Employee benefits plans and plan participants affected by COVID-19 have extensions for employee benefit deadlines. The Department of Labor and the Department of Treasury issued relief for both participants in employee benefits plans as well as for plan officials.

- Participants deadlines extend until 60 days after the end of the National Emergency, participants receive extensions for

- Special enrollment under HIPAA

- Electing COBRA continuation converge, paying COBRA premiums, and informing the plan of a COBRA qualifying event.

- File benefit claims and appeals, and request an external review of denied claims.

- The Disaster Relief Notice 2020-01 states plan officials have an extension to furnish benefit statements and other notices and disclosure required under ERISA. This relief is available to plans that act in good faith to create the documents as soon as possible. These disclosures include:

- The Summary Plan Description

- Summary of Material Modifications

- Summary of Benefits and Coverage

- Participants deadlines extend until 60 days after the end of the National Emergency, participants receive extensions for

- Sick Pay and Family Leave: Under the FFRCA if employees are unable to work due to COVID, they can receive up to 80 hours of sick leave with full pay. If employees must stay home with their children due to the closure of schools and childcare they can receive up to 12 weeks of family leave.

We understand that this unpredictable time is difficult. It is important to utilize the resources available that provide relief for employees and business owners. For more information regarding your company’s ability to mitigate risk during these tough times, contact Roger Stewart at IOA!