The commercial real estate industry is a high stakes deal-making environment. Commercial real estate investors are expected to find opportunities that provide their clients with the lowest possible risk, the best return on investment, and the best capitalization rate.

Not only do you represent the tenants of a business, but also the building owners/lessors and investors. It’s essential that you have Errors and Omissions Insurance to ensure you remain protected.

What is Errors and Omissions Insurance?

In the CRE industry, agents are at a higher risk of being accused of failing to meet a client’s expectations, failing to document decisions or actions, or failing to act in a customer’s best interest. This could be an error on a title, or an oversight in a property listing, which could lead to a costly lawsuit.

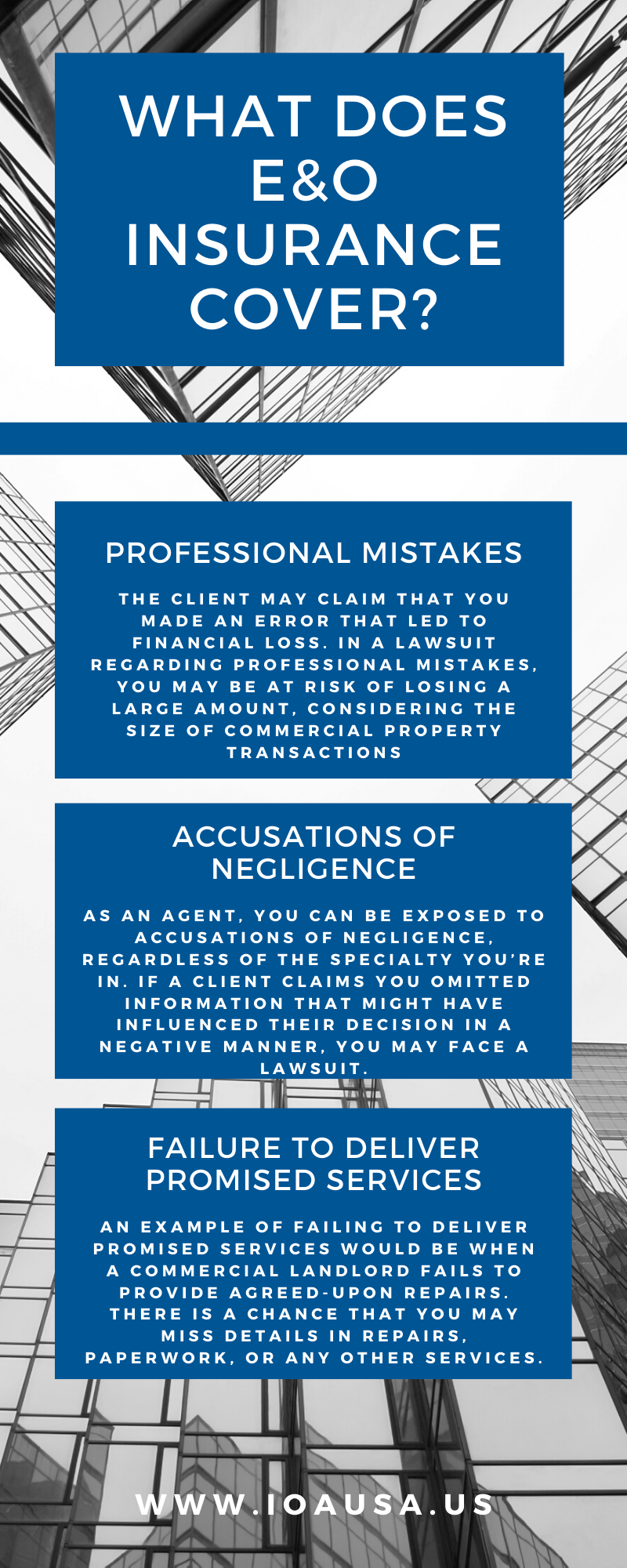

Errors and Omissions insurance covers against financial losses from lawsuits filed as a result of an agent’s work in the real estate profession. These policies cover liability related to the following issues.

Professional mistakes

The client may claim that you made an error that led to financial loss. In a lawsuit regarding professional mistakes, you may be at risk of losing a large amount, considering the size of commercial property transactions.

An example of this is when a real estate agent misstates the square footage of a property. If the agent has Errors and Omissions Insurance they are covered for attorney’s fees, court costs, settlements, judgments, and fines.

Accusations of negligence

As an agent, you can be exposed to accusations of negligence, regardless of the specialty you’re in. If a client claims you omitted information that might have influenced their decision in a negative manner, you may face a lawsuit. E&O insurance can assist with legal expenses related to this issue, regardless of if you are in the wrong.

Failure to deliver promised services

An example of failing to deliver promised services is when a commercial landlord fails to provide agreed-upon repairs. There is a chance that you may miss details in repairs, paperwork, or any other services. E&O insurance helps pay the cost of hiring a lawyer, and cover any additional costs related to the lawsuit.

While it’s important to know what E&O insurance covers, it’s also important to understand potential exclusions.

Some common exclusions in E&O coverage include claims resulting from dishonest or criminal acts. As well as claims associated with a polluted property. If any agent causes bodily harm or death to another person, or the agent causes damage to someone’s property, their claims will not be covered under E&O insurance.

In the CRE industry, it is more common to face a lawsuit related to errors and omissions. It’s best to be prepared with E&O insurance before you need it. Roger J Stewart is an expert in providing coverage for real estate professionals. He has helped various CRE investors and agents avoid risk and save money.