Don’t just roll the dice: know the added risks of business insurance in the Casino Industry

Owning a casino is a risk in and of itself. When you become a casino owner or manager, the first thing you must do is assess your casino’s risk. In order to protect the house from all potential risk factors, you need a pit boss that knows his stuff. In order to protect your casino as a business, you need an insurance broker who understands your industry, the equivalent of an insurance pit boss.

With all the risks associated with the casino and gaming industry, it’s important you know how to protect yourself. Your risk is not something to roll the dice on. In order to effectively mitigate your risk, you need to know what type of casino insurance you need.

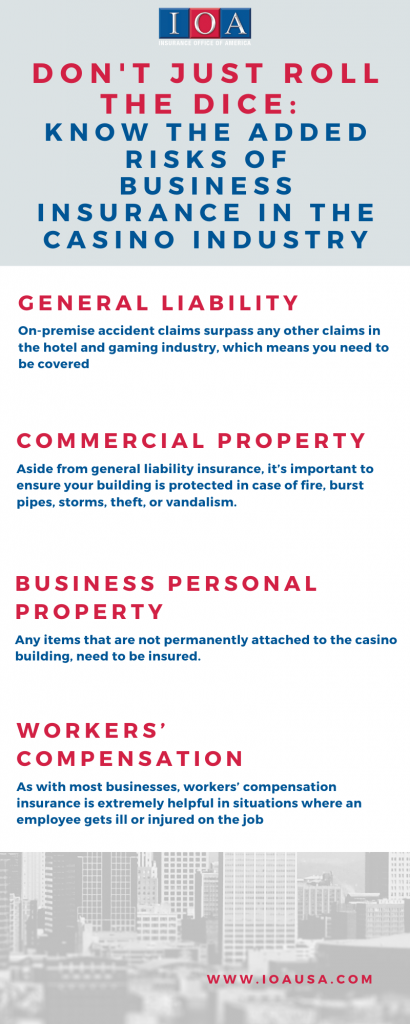

General Liability Insurance

On-premise accident claims surpass any other claims in the hotel and gaming industry, which means you need to be covered and know the industry exemptions. General Liability insurance will cover any minor incidents that occur during your customers’ time in the casino.

On-premise accident claims are not something to gamble with. In order to ensure your customers remain safe at all times and your image remains intact you need to be protected. Protect yourself with the right coverage and with the right HR handbooks and regulatory requirements.

One of the best ways to protect yourself before an incident occurs is to ensure your facility and maintenance upkeep is the highest priority. Having up to date policies and procedures is crucial to protecting your workers and thereby, your business.

Commercial Property Insurance

Aside from general liability insurance, it’s important to ensure your building is protected in case of fire, burst pipes, storms, theft, or vandalism. If any of these situations were to occur, you would want to have commercial property insurance.

As we’ve seen this past year, you can never be too prepared. As we’ve also seen this year, situations that you think would be covered are often exempted. It’s time to review your existing policy to ensure that your coverage has not been decimated by exemptions. During this volatile time, it is crucial that for those exemptions as you plan for quarter one of 2021.

Business Personal Property Insurance

Any items that are not permanently attached to the casino building, need to be insured. Business personal property insurance provides coverage for slot machines, roulette tables, poker chips, furniture, etc. Be sure you are prepared in case an incident occurs.

Many casinos are located in resort areas. With rising sea levels and temperatures, inclement weather is more and more of a regular threat. Revisit your coverage to ensure that your policy still covers your assets. The 2020 fire season, for example, has caused premiums to skyrocket in certain more vulnerable areas.

Workers’ Compensation Insurance

As with most businesses, workers’ compensation insurance is extremely helpful in situations where an employee gets ill or injured on the job. Without proper coverage, you could face a hefty lawsuit.

As you look to insure your casino, be sure you hire an expert to help you assess any potential risk associated with your business. Roger J. Stewart, partner at IOA, has over 18 years of experience helping business owners, like you, protect their assets.