Have you heard about the recent changes surrounding independent contractor status in California?

If you haven’t, let us first acknowledge that California laws about independent contractors are murky and difficult to understand. If you use independent contractors in your business, you will want to be aware of recent changes.

We want to take some time to go over these changes and share some tips for protecting yourself and your company, as there may be insurance available to protect you (namely, EPLI coverage).

Laws Around Independent Contractor Status

There have been three recent actions in California that have impacted businesses’ ability to legally use independent contractors. They are:

To be frank, these changes are about as clear as mud unless you’re well versed in legal text. However, there are a few clear takeaways. All three laws affect a business’ ability to use independent contractors. The laws define the circumstances when a worker must be classified as an employee.

First, in 2018, the Dynamex decision was a landmark California Supreme Court case that held that the truck drivers for a shipping company had to be classified as employees. The Court unveiled the three-part “A-B-C” test to determine whether a worker is an independent contractor or an employee. To be an independent contractor, the worker:

A. Must be free from the control and direction of the hirer in connection with the performance of the work; and

B. Must perform work outside of the usual course of the hirer’s business; and

C. Must be customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed.

The “B” prong of the A-B-C test was the real dagger for companies: businesses cannot use workers as independent contractors in the same line of work as the business itself.

-For example: a marketing company can hire painters as independent contractors to come in and paint their office, but a painting company cannot hire painters on an independent contractor basis.

Notably, it is the employer’s burden to establish that a worker meets all three requirements of the A-B-C test. If a worker is found to be misclassified as an independent contractor, not only may:

(1) The worker sue to recover unpaid wages and the failure to provide meal and rest breaks; but also

(2) The State of California may fine the employer for unpaid contributions to the state workers’ compensation and unemployment insurance funds.

Second, in 2019, the California Legislature codified the Dynamex decision in Assembly Bill 5. The bill wrote the A-B-C test into the Labor Code, mandating all workers be classified as employees unless they satisfy all three prongs of the test.

Some professions were exempt from the scope of AB 5, notably insurance agents, doctors, lawyers, and engineers. Also, the new law contemplated some freelance workers – such as journalists and photographers – should not be subject to the new law. Finally, AB 5 provided a “business-to-business” exemption, where if two bona fide companies are contracting with each other, neither had to be the employee of the other.

Connect With Us Today

The passage of AB 5 led to a flurry of lobbying efforts by California businesses, all trying to be included as one of the law’s exemptions. That is where AB 2257 comes in.

Passed just this year, AB 2257 keeps the A-B-C test intact, but it adds new exemptions. Now, there are dozens more industries that can ignore the A-B-C and use independent contractors more freely, ranging from landscape architects to musicians to home inspectors.

The Long and Short of It

AB 2257 is good for businesses in many ways because it provides more opportunities for independent contractor use. AB 5 required employee classification too frequently, and AB 2257 helps remedy that. Another big win for businesses is that AB 2257 applies retroactively. If businesses are currently in litigation, they can retroactively apply Labor Code section 2785(b) to existing claims in some cases.

However, despite these changes, the national rate of misclassified workers sits between 10% and 30%. This creates a lot of risk for employers, which makes understanding and preparing for these changes and potential claims even more important.

What You Should Do to Protect Yourself

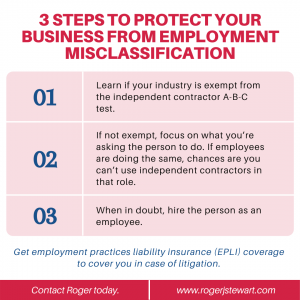

Employers should exercise extreme caution when considering the use of independent contractors. We asked Brent Douglas, a partner at Hahn Loeser, about how companies can protect themselves. His advice was:

(1) “First, learn whether your company is in one of the industries exempt from the A-B-C test.”

(2) If companies are not exempt, then “they should focus on what they are asking the person to do. If they currently have employees performing similar tasks, the chances of being able to legally use independent contractors is low.”

(3) When in doubt, Douglas recommends simply employing the person. “I would say 90% of the time when clients call me asking if they can hire someone as a contractor, the answer is ‘no.’”

Due to the complexity of the issues and severity of the penalties for misclassification of independent contractor status, there are a couple of things you should do right away.

-Consider contacting an attorney to review your specific situation. They’ll be able to provide invaluable legal counsel that can help guide your independent contractor classification and practices.

-Take time to protect yourself with liability insurance. Consider increasing or adding EPLI (employment practices liability insurance), which includes coverage for employment-related claims. These claims include everything from litigation surrounding wrongful termination to claims of discrimination and more (learn more about EPLI coverage here). Make sure your EPLI coverage is enough to protect you from any fallout from these changes or litigation related to employment misclassification.

Taking these two steps will help ensure you’re prepared for any employment misclassification claims related to recent laws.

To discuss your employment practices liability insurance (EPLI) needs, contact Roger today.

Conclusion

Changes in California’s independent contractor status, prompted by Assembly Bill 5 (AB 5), reclassify many workers as employees rather than contractors. This impacts companies by increasing obligations for benefits and compliance with labor laws. The “ABC test” determines a worker’s status, requiring proof that contractors operate independently and perform work outside the company’s usual course of business. Businesses must reassess worker classifications and potentially adapt to new regulatory requirements. Readers are encouraged to connect with Roger J. Stewart today to discuss the latest regulatory requirements.