The very name “excess liability coverage” is upsetting to some consumers. In fact, we hear their concerns all the time: “I’m paying enough for my regular insurance! Why do I need so-called ‘excess insurance’?” Add to that the cost of cyber insurance, a relatively new line of insurance, and some consumers are downright exhausted with the entire commercial insurance industry.

In this article, we’ll explain why these two lines of insurance – excess/umbrella liability coverage and cyber liability coverage – are important parts of your portfolio. We’ll also explain why consumers can expect to pay more for this coverage in their upcoming policy periods and how they can get the best coverage for their money despite these increases.

What is excess/umbrella liability coverage?

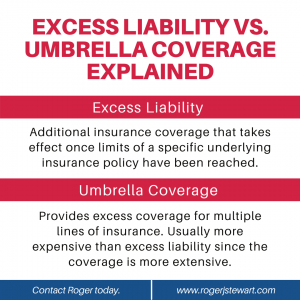

Excess liability coverage, sometimes referred to as an “umbrella policy,” is insurance coverage that kicks in once the limits of your regular policy have been exhausted. There are important differences between the two, however.

Excess liability coverage kicks in once the limits of a specific underlying policy have been reached. Let’s say you were insured for $1,000,000 against flood damage and your property suffered $1,000,900 worth of damage in a flood event. Generally speaking, your excess liability policy would cover the additional $900 in damages you experienced in that loss event. Given that an excess policy is usually tied to one specific policy type, that same excess liability coverage would not cover any overages if, for example, your property was damaged by a reckless driver instead of a flood.

Umbrella coverage, on the other hand, is intended to provide excess coverage for multiple lines of insurance. So, if your losses exceeded your policy limits for natural disasters, general liability, or errors & omissions, your umbrella policy could be used to cover excesses in any of those categories. Due to its more extensive coverage, an umbrella policy tends to be more expensive than excess liability coverage.

What is cyber liability insurance?

Cyber liability coverage is one of those things that makes some of us long for the days before computers. As the name suggests, it’s a type of coverage that insures against attacks on our computers, networks, and data. Sadly, cyber attacks are only becoming more frequent, with events like ransomware attacks (where one’s data is encrypted and held for ransom) leading most other cyber risk possibilities. Of course, cyber liability policies also protect against other technology breaches, such as network hacks, identity theft, and even cyber bullying.

While these policies would have been inconceivable just 30 years ago, today’s businesses rely heavily on them. This is especially true post-COVID, when the vast number of remote workers caused a surge in cyber-crime and cyber vulnerabilities.

What’s behind cyber insurance premium increases?

Existing market trends and predictions suggest that both excess liability premiums and cyber liability premiums are increasing for upcoming policy periods. The reasons for this are as simple as they are disheartening: when the market sees a drastic increase in the number of claims and awards, consumers see corresponding increases in premium prices.

As for excess/umbrella coverages, the math is simple. According to one industry source, “Insurance carriers are facing increased litigation, broader definitions of liability, more plaintiff-friendly legal decisions and larger compensatory jury awards.” Given this climate, insurers are passing their rising costs on to consumers.

Connect With Us Today

As for cyber policies, while the number of cyber-related claims did not increase as dramatically as some predicted in 2020, the success of the claims that were filed rose sharply. The end result is the same: it became more expensive for insurers to offer these policies; therefore, the cost of cyber insurance policies themselves became more expensive. While this year’s cyber insurance premium increase is understandable, experts do expect premiums to level off in future years as more companies purchase these policies and the industry learns how to better assess their risk.

What to do about this coverage going forward

Unfortunately, the increases we’re seeing in the cost of cyber insurance and excess insurance are across the board. The increased risk climate has simply precluded any deals within the marketplace. For now, the best thing you can do for your business is to choose a broker known for honesty, integrity, and long-standing, productive relationships with underwriters. If you want to talk about your coverage options as your policy renewal period approaches, please don’t hesitate to contact Roger.

Conclusion

Excess liability and cyber insurance premiums are rising due to increased claims and larger jury awards in excess liability cases, as well as the success of cyber-related claims. Excess liability, also known as umbrella coverage, provides additional coverage when standard policies are exhausted, while cyber liability insurance protects against digital threats. Businesses should ensure comprehensive coverage despite these cost increases by working with trustworthy brokers and regularly reviewing policy needs. Readers are invited to discuss their comprehensive insurance needs with Roger J. Stewart by filling out the provided form.